In this piece I’ll examine how markets are currently configured and which clues have been left behind. I’ll look at the macro picture and distill potential scenario’s and target zones for the German DAX index.

Global markets have been in a down swing the last couple of weeks on the back of the potential for a trade war with China and tariffs looming over Mexico. Added to this already nice cocktail are PMI’s, jobs numbers and inflation data in Europe & US that are definitely slumping. Today it was the ADP Non-farm employment change reaching levels not seen since 2010. The bright spot seem to be the non-manufacturing PMI’s which are coming in above expectations the last few days. Nevertheless, the global economy and activity show all signs of slowing down.

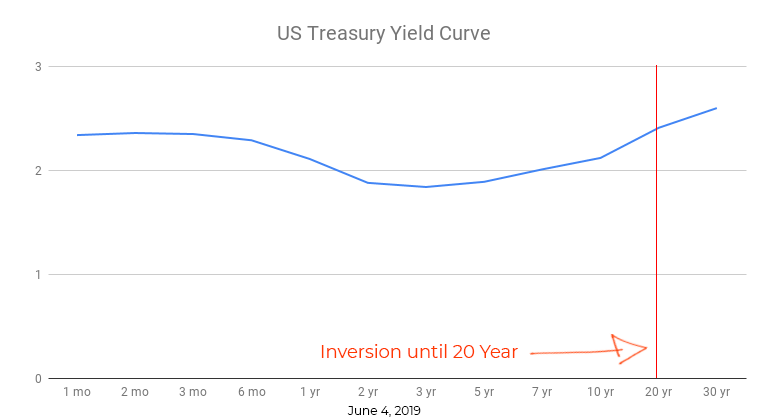

The US Treasury Yields show an interesting picture, inverted all the way up to the 20 year yield

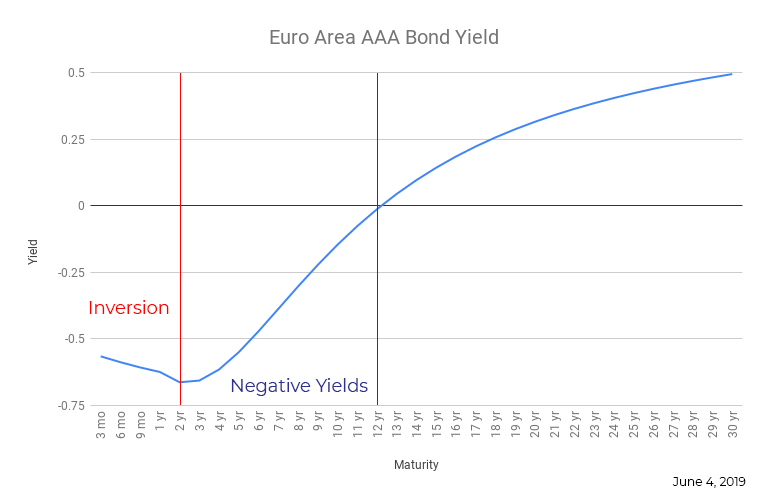

Due to the fact that the ECB has not seen any opportunity in the last decade to raise rates, negative yields are showing up until a maturity of 12 years! Let that sink in for a moment. The inversion is less severe. Considering they are in negative territory, ‘less severe’ is probably a gross understatement.

Meanwhile the Bund Futures gapped into new highs on very strong volume, and has been keeping steady. Today it even printed a new high. However, that gap is bound to get filled at some point and it seems reasonable to at least expect some mean reversion / consolidation.

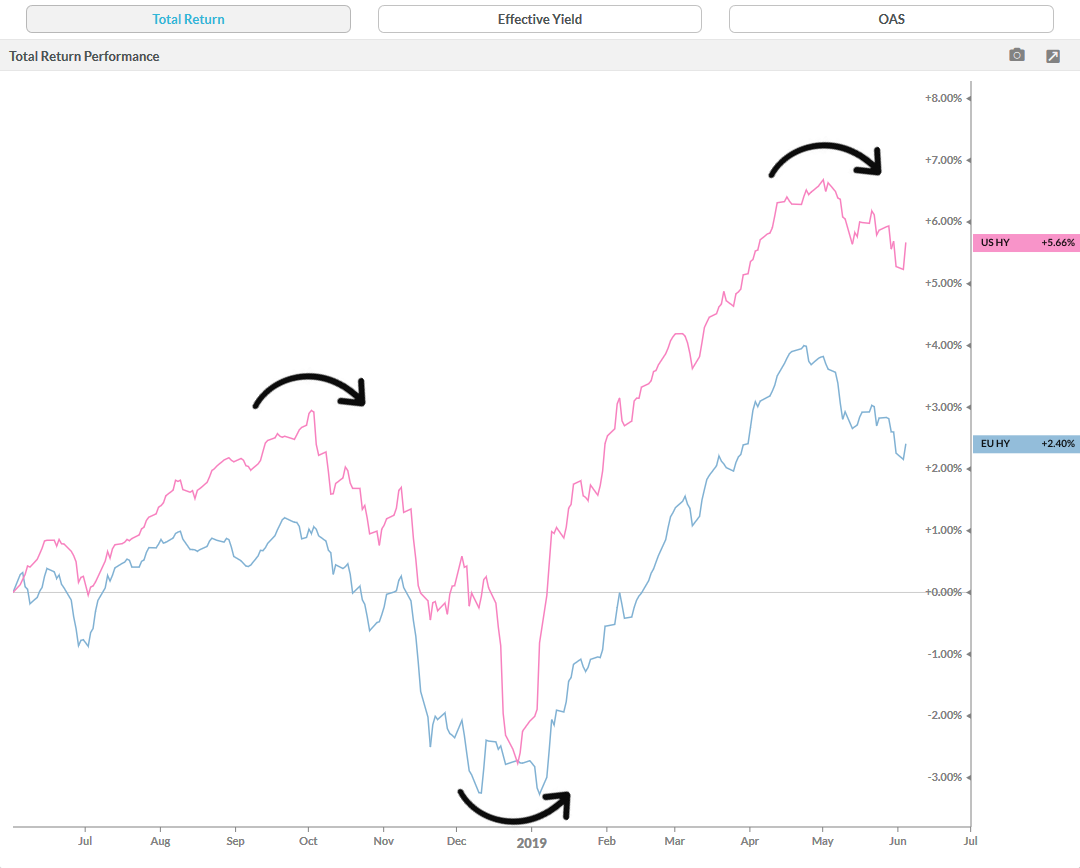

Starting this week DAX and the US Indices have caught a bid and have mean reverted. What I find interesting is that the same can not be said about both Bonds and the HY Credit markets. This is an interesting divergence. Which market is correct here? Note how the HY markets have clearly marked the 2019 January bottom, and the October 2018 highs.

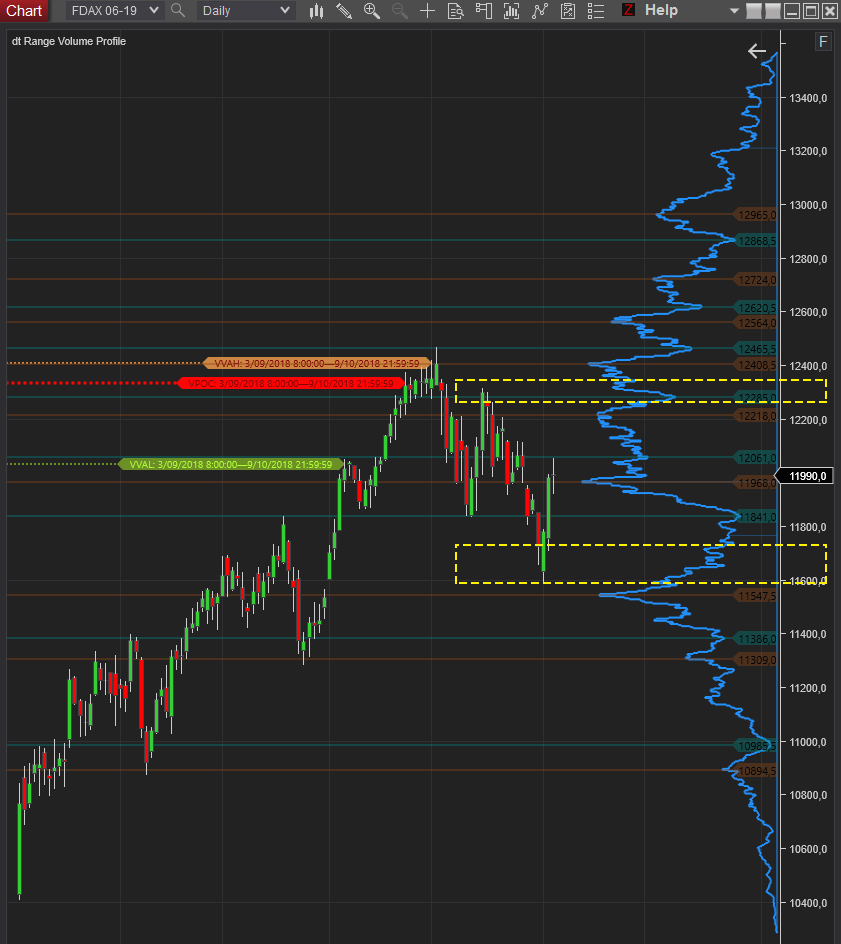

Looking at the weekly chart, you’ll notice that volatility in Europe is still relatively muted.

On the daily chart, you can see a compression pattern after gapping higher at the start of May. My expectation is a break out from this pattern after the ECB announcement.

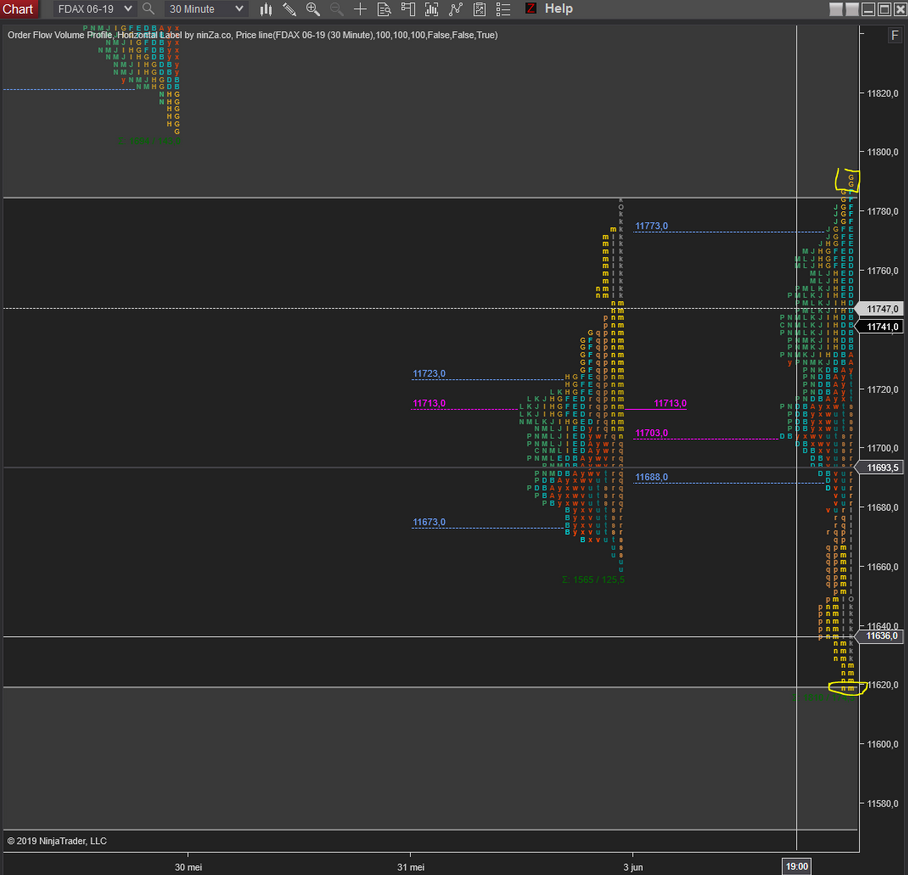

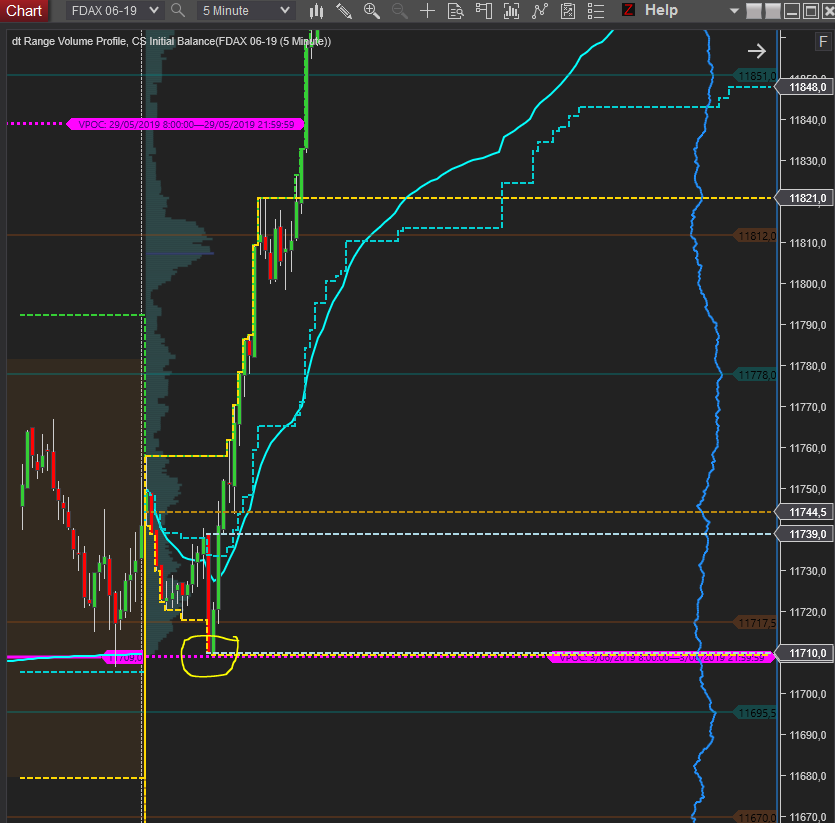

Zooming in to the intra-day chart of the front month, a downward channel can be observed. Of note here is that we are currently trading below the Volume Point of Control for this contract.

Despite the rally in equity indices in Europe and the US, there are some notable diverging markets.

Oil and Copper tend to correlate with a “risk-on” mood, however, they didn’t catch a bid. Gold, which tends to inversely correlate, also wasn’t sold during this weeks strength. While that is just a data point, I find it interesting neither of these, nor the credit and bond market, are in agreement with the rise in Equity Indices.

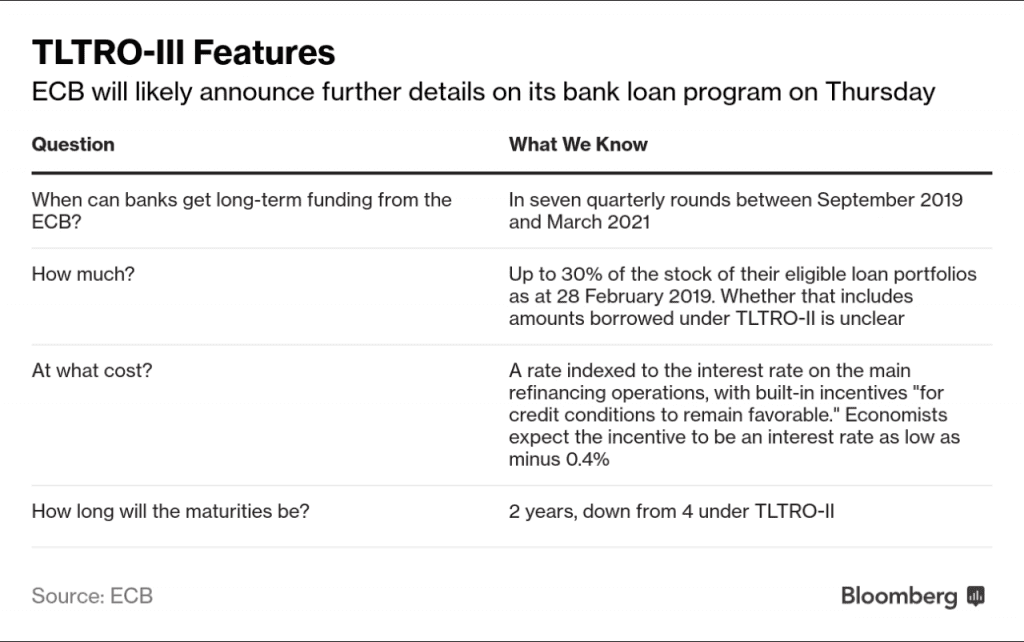

Yesterday Fed officials came forward and basically delivered a “whatever it takes” statement. Across the pond we need to give credit to Mr. Draghi, for coining that term many years ago. Rumours on TLTRO 3 have been floating around for some months now, and it seems more and more market participants are expecting an announcement. Courtesy of Bloomberg, a short intro:

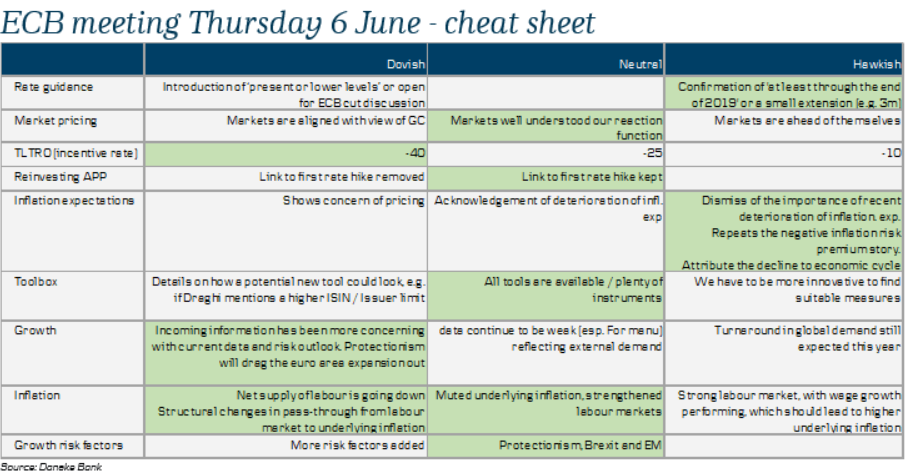

Danske Bank also published a cheat sheet – or as I would like to call it – the Algo parameters

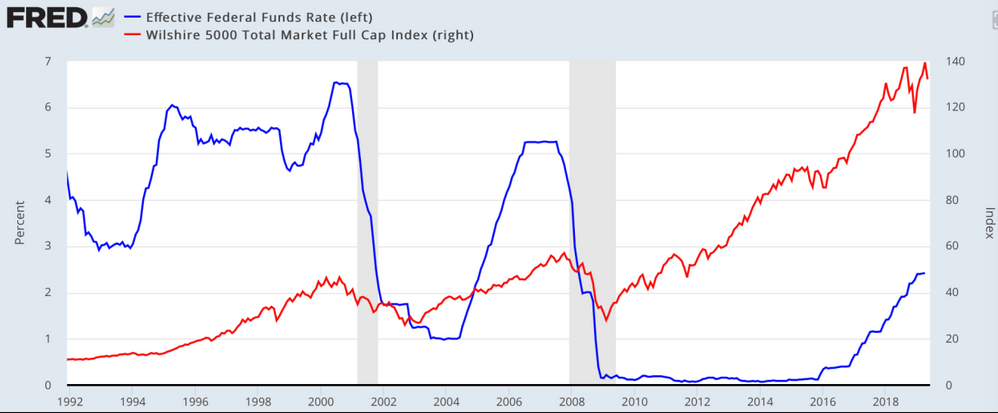

Market participants have recently been pricing in 2 – 3 rate cuts for the US yields in 2019. With the statements made by the Fed officials yesterday, it seems they are open to the idea. While that might seem like a bullish catalyst at first, consider what happened the last 2 times that happened at the end of a business cycle. Posted on Twitter by @NorthmanTrader – I highly recommend a follow.

Now on to my product of choice, the DAX. Considering all the above, I’ll present my take on what might happen, and some important clues that I have noticed the last few trading sessions.

In a nutshell, my primary scenario:

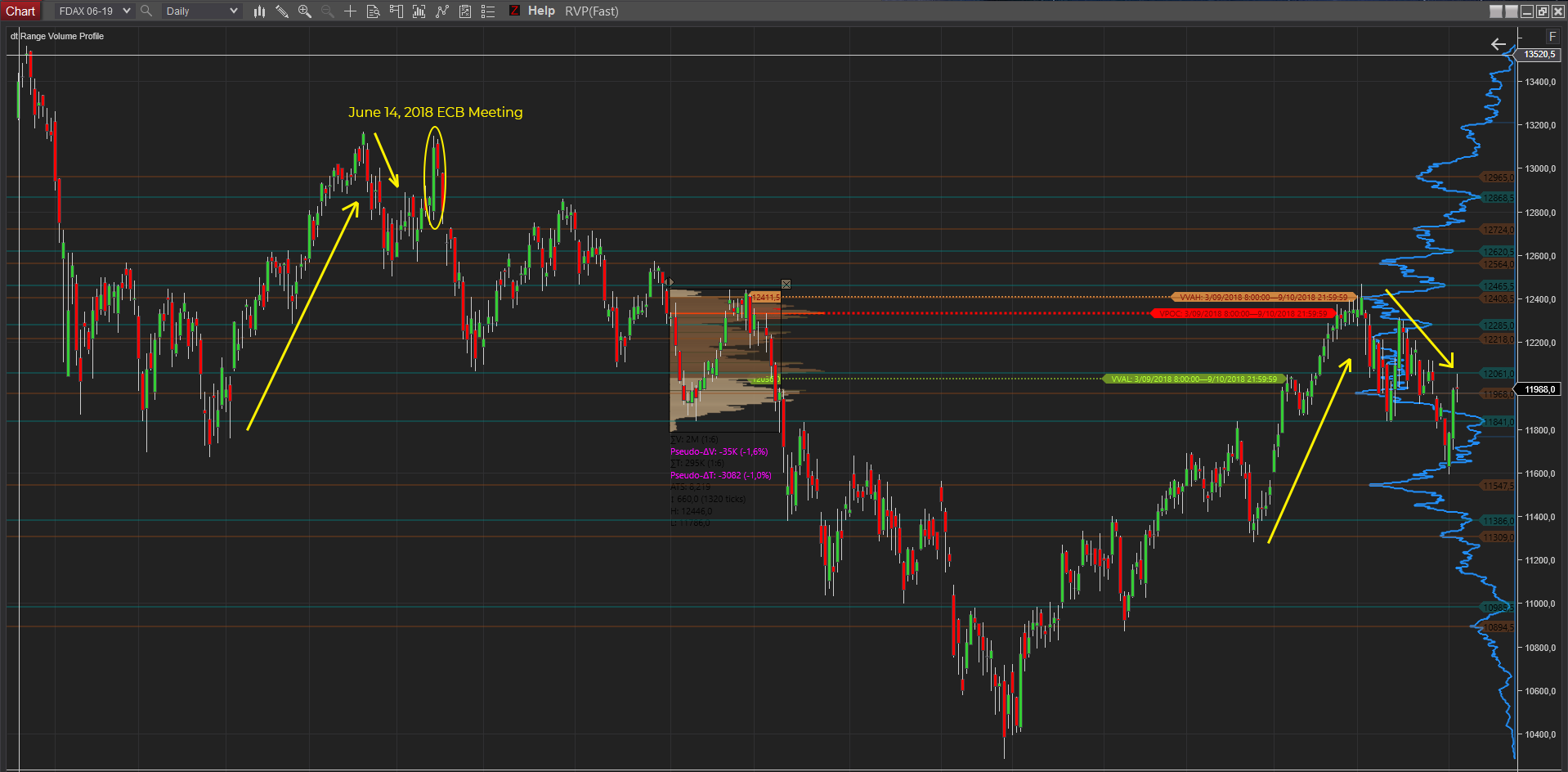

One of the reasons for this, is that a similar scenario played out not too long ago on an ECB day, with similar market conditions. Coincidently, that happened exactly a year ago, in the June 14 meeting of 2018. While I don’t exactly remember the specifics of what was announced, I do remember how the market traded: it went no offer for the complete day. The market is in a similar configuration now, after a huge rally starting in 2019, we have now corrected some and have mean reverted this recent drop.

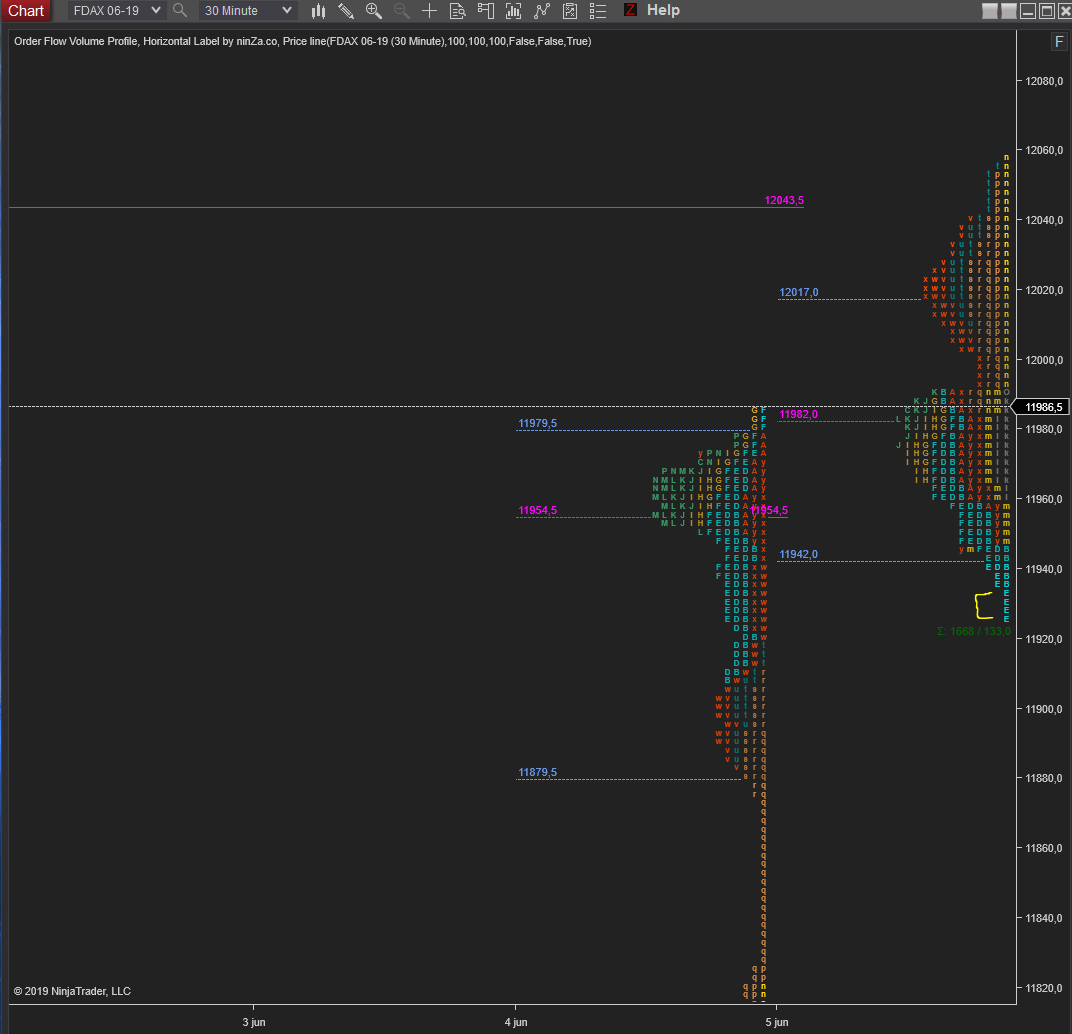

Another reason I’m expecting a deeper sell off to come is because the market did some unusual things this week:

These are typically indications of shorter term trading money, and suggests to me that what we have seen this week was short covering. In doing so, the market filled the gaps left behind when the last selling spree started.

And as posted this morning on my Twitter feed, it looked like today was going to be a balancing day. Which is indeed what played out, with the market basically closing unchanged. We see good excess on the low of the day, and a rather questionable high of the day (almost a double top). 12000 looks like an important cut off point to watch tomorrow.

In case of big moves, my upward target is around 12300 and downward targets Monday’s and Tuesday’s lows.

Deutsche Bank has hit a new all time low this week, due to several reasons. Low yields, allegations of fraud and money laundering, poor numbers, the list goes on. Considering the size of it’s derivative portfolio, it surely is a systemic bank.

Even if the outlined scenario does not play out, it is important to keep track of all the divergences currently taking place across markets. Something is off here, and maybe the Fed and ECB can save these markets. I, for what it’s worth, am starting to doubt it.

Kevin is the founder of Chart Spots and has been active in the financial markets since 2016. With a background in IT and business consulting that dates back to 2006, he combines technical expertise with real-world trading experience. Kevin founded ChartSpots in 2017 to provide data-driven tools and insights that empower traders at all levels.

Read our Disclaimer , Terms and Conditions and Privacy and Cookie Policy.

CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.

GOVERNMENT REGULATIONS REQUIRE DISCLOSURE OF THE FACT THAT WHILE THE TRADING IDEAS AND TRADING METHODS SHOWN ON THIS WEBSITE MAY HAVE WORKED IN THE PAST; BUT PAST RESULTS ARE NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. WHILE THERE IS A POTENTIAL FOR PROFITS THERE IS ALSO A HUGE RISK OF LOSS. A LOSS INCURRED IN CONNECTION WITH TRADING FUTURES CONTRACTS, STOCKS, OPTIONS OR FOREX CAN BE SIGNIFICANT. YOU SHOULD THEREFORE CAREFULLY CONSIDER WHETHER SUCH TRADING IS SUITABLE FOR YOU IN LIGHT OF YOUR FINANCIAL CONDITION SINCE ALL SPECULATIVE TRADING IS INHERENTLY RISKY AND SHOULD ONLY BE UNDERTAKEN BY INDIVIDUALS WITH ADEQUATE RISK CAPITAL.

RISK DISCLOSURE: FUTURES AND FOREX TRADING CONTAINS SUBSTANTIAL RISK AND IS NOT FOR EVERY INVESTOR. AN INVESTOR COULD POTENTIALLY LOSE ALL OR MORE THAN THE INITIAL INVESTMENT. RISK CAPITAL IS MONEY THAT CAN BE LOST WITHOUT JEOPARDIZING ONES’ FINANCIAL SECURITY OR LIFE STYLE. ONLY RISK CAPITAL SHOULD BE USED FOR TRADING AND ONLY THOSE WITH SUFFICIENT RISK CAPITAL SHOULD CONSIDER TRADING. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS

TESTIMONIAL DISCLAIMER: TESTIMONIALS APPEARING ON CHARTSPOTS.COM MAY NOT BE REPRESENTATIVE OF THE EXPERIENCE OF OTHER CLIENTS OR CUSTOMERS AND IS NOT A GUARANTEE OF FUTURE PERFORMANCE OR SUCCESS

ALL INFORMATION ON THIS WEBSITE IS PROVIDED FOR EDUCATIONAL PURPOSES ONLY AND NOT AN OFFER OR A RECOMMENDATION TO TRADE FUTURES CONTRACTS, STOCKS, OPTIONS OR FOREX.